ct sales tax on cars

The tax due in is called use tax rather than sales tax but the tax rate is the same. Sales From Licensed Dealers - If the vehicle was purchased from a licensed dealer the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price.

Sales Taxes In The United States Wikipedia

Sales Tax Relief for Sellers of Meals.

. Connecticut collects a 6 state sales tax rate on the. 775 Most motor vehicles with a sales price of more than 50000. The sales tax is 635 percent for vehicles purchased at 50000 or less.

Norwalk CT Sales Tax Rate. CT Use Tax for Individuals. Connecticut charges 635 sales and use tax on purchases of motor vehicles.

Ad Access Tax Forms. All sales rentals leases and title transfers of goods. 635 or 7 if the car s value is more than 50000.

Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. Lease payments due and owing on or before. The answer depends on whether the resident paid any sales tax to the state in which the vehicle was purchased.

The current sales tax in Connecticut is 635 for vehicles that are 50000 or less. Where the repaired motor vehicle is owned by and used in carrying on a business Connecticut use tax must be reported and paid on such purchases by filing a Form OS-114 Connecticut. Initially a mill rate of 29 was proposed and would have cost the state 160 million a year.

Sales and Use Tax. The sales tax is 775 percent for vehicles over 50000. New Haven CT Sales Tax Rate.

Instead of relying on the price given on a. In Connecticut and six of the other states the state sales tax is assessed on the full 18000 price of the car. Special sales tax rates of 45 apply to the sale of motor vehicles and 1 on the sale of computer and data processing services.

See Policy Statement 20022 Sales and Use Tax on Meals for more information. Norwich CT Sales Tax Rate. The Farmers Tax Exemption Permit form.

Complete Edit or Print Tax Forms Instantly. Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. This means that if you purchase a new vehicle in Connecticut then you will have to pay an additional 635.

In addition to taxes car purchases in Connecticut may be subject to other fees like registration title and plate fees. The sales tax is 635 percent for vehicles purchased at 50000 or less. The sales tax is 775 percent for vehicles over 50000.

30000 Initial Car Price 2. Sales of motor vehicles with a sales price of more than 50000 made on or after July 1 2011 are subject to the 7 rate. Lowering the tax cap however will cost the state about 100 million annually.

The sales tax is 635 percent for vehicles purchased at 50000 or less. North Stamford CT Sales Tax Rate. Download Or Email CT DRS More Fillable Forms Register and Subscribe Now.

Tennessee car buyers pay local sales tax ranging from 15 to 275 percent on the first 1600 plus state sales tax of 7 percent on the entire purchase price. Leases of motor vehicles. The sales tax is 775 percent for vehicles over 50000.

But in Massachusetts the dealer could deduct the 2000 rebate. Connecticut charges 635 sales and use tax on purchases of motor vehicles that cost 50000 or less and 775 sales and use tax on motor vehicles that cost more than 50000 CGS 12. Sales of meals and certain beverages.

There S A Plan To Get Rid Of Property Tax On Cars But How Would Towns Make Up The Difference

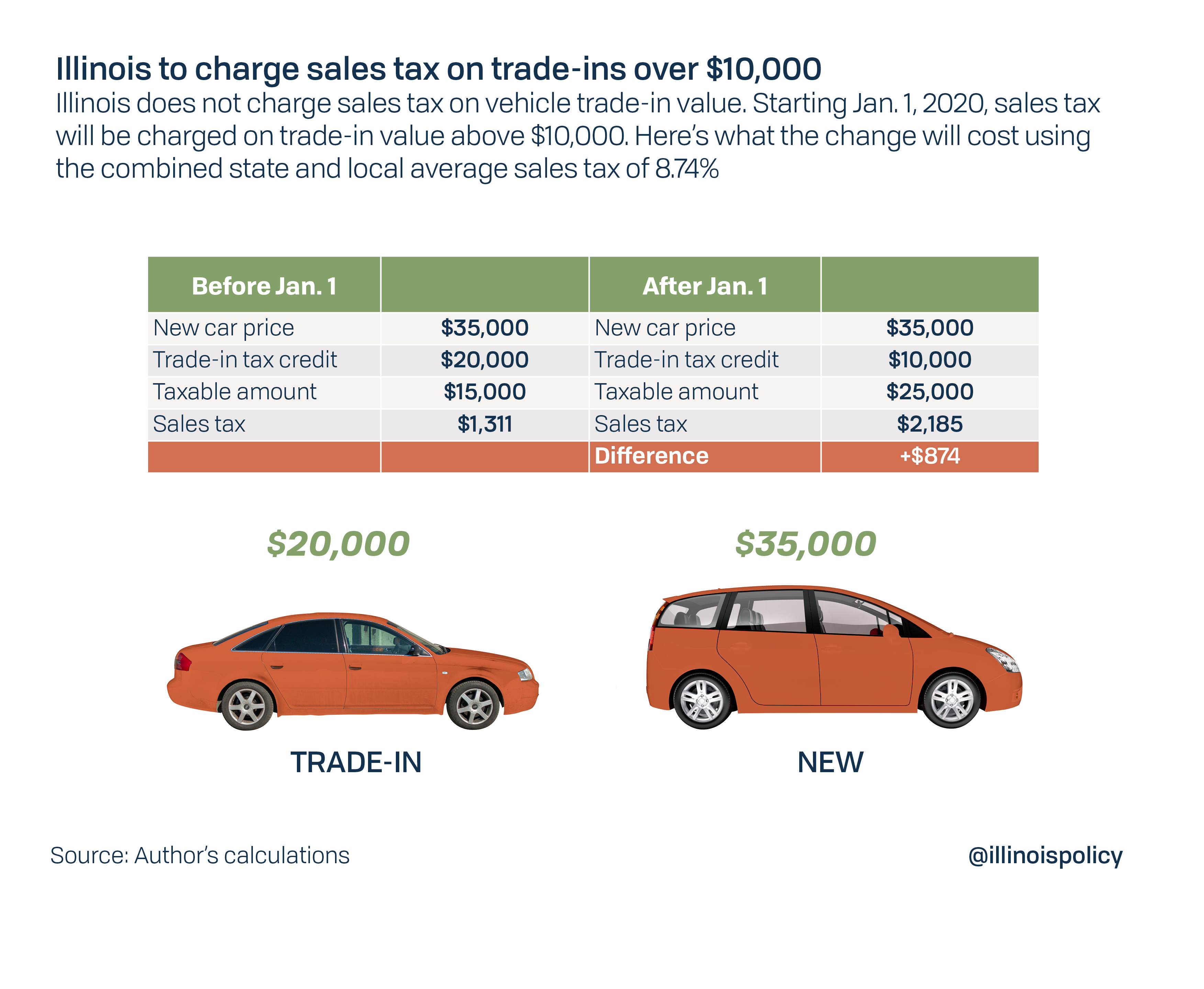

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

What New Car Fees Should You Pay Edmunds

Used Cars Near West Hartford Ct At Schaller Honda

Used Saab For Sale In New Haven Ct Cargurus

Connecticut S Sales Tax On Cars

Used Lexus Ct Hybrid For Sale In Escondido Ca Cargurus

Connecticut Vehicle Sales Tax Fees Calculator Find The Best Car Price

What Malloy S Proposed Trade In Automobile Tax Means For Connecticut Car Buyers Manchester Ct Patch

Which U S States Charge Property Taxes For Cars Mansion Global

Connecticut S Sales Tax On Cars

Dashcars Used Car Dealership Near Milford Ct

What S The Car Sales Tax In Each State Find The Best Car Price

Used Cars In Connecticut For Sale Enterprise Car Sales

Infiniti Tax Return Special Infiniti Sales In Hartford Ct

Connecticut S Sales Tax On Cars

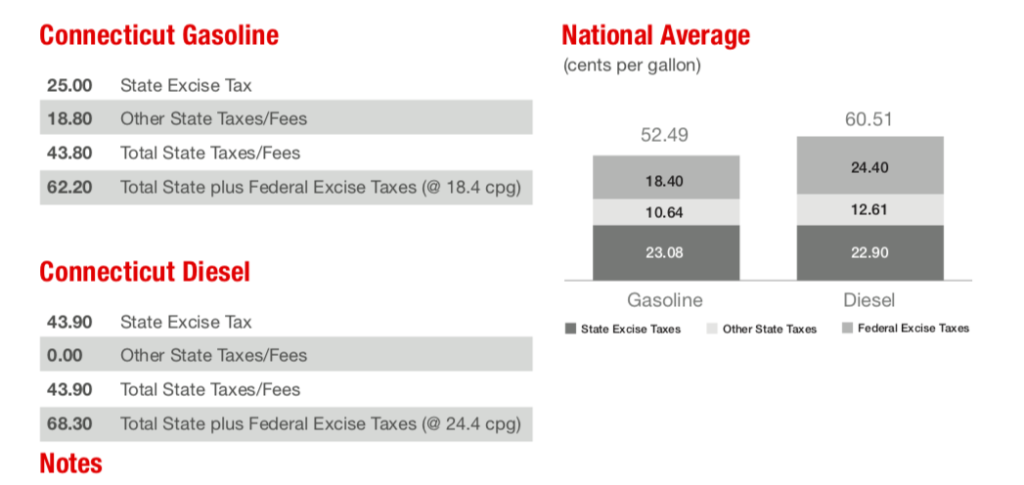

Connecticut Gasoline Tax 7th Highest In The Nation Yankee Institute